see all jobs

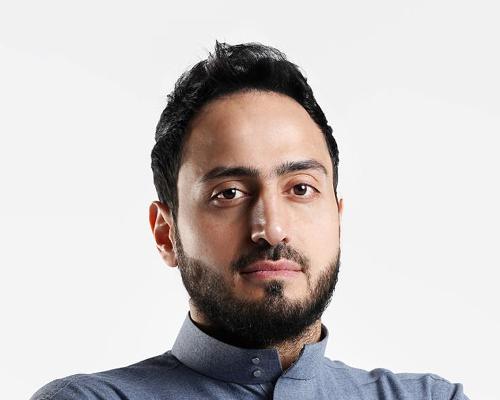

Armah Sports reveals plans for IPO – the second in five years for CEO, Fahad Alhagbani

Fahad Alhagbani, CEO of Saudi-based health club operator, Armah Sports has told HCM he plans to do an IPO before the end of 2023.

The company will be listed on the Saudi Stock Exchange Parallel Market (NOMU), with plans to eventually move to the main market.

The IPO will be the second in five years for the Alhagbani family, following the successful flotation of their previous business, Fitness Time, in 2018.

"We've been engaged with investors in the last three months, with the majority having previously taken part in the Fitness Time IPO," said Alhagbani.

The company has launched two main brands since it was founded in 2019 – high-end concept Optimo and premium brand, B_Fit, with another couple of concepts in the works.

“Saudi has a great potential, the fitness market has doubled since 2017 and is expected to double again by 2027. There are so many drivers behind this growth,” said Alhagbani.

The IPO is expected to involve the issuing of 4.93m shares for 15 per cent of the business, with the proceeds used to ramp up the construction and fit-out of clubs and the purchasing of fitness equipment, as well as covering short-term working capital requirements.

“We intend to utilise the proceeds within two to three years of the IPO,” said Alhagbani. “Our number one priority is delivering value to our members, community, employees, stakeholders and investors.

“We’re not aiming to build 150+ locations as we did with Fitness Time” he said. “The plan is to build a more intimate network of health clubs in major cities in Saudi and to focus on quality and the member experience, rather than quantity and growth. We also want to remain lean and agile.

“Back in 2018 when we listed Fitness Time in the main market it had taken us more than two years to prepare the company to float with the help of Investcorp, our private equity partners at the time.

“We got a 16.2 multiple on net income, creating a valuation north of US$720m. it was one of the milestones in our lives,” he said.

In contrast, the Armah IPO has been prepared in-house, as there are no institutional investors involved: “This time we did the IPO processes alone – of course, with our financial and legal advisors – as we control 100 per cent of the company,” said Alhagbani. “We’ll also be majority shareholders post-IPO, holding 85 per cent of the business, as we’re only floating 15 per cent.

“We wanted to create history and set a precedent to the fitness industry by being the first team to IPO twice in five years, while also showing a commitment to corporate governance which adds transparency and accountability for future investors," continues Alhagbani.

“When we started Armah Sports Company in early 2019, we planned to institutionalise the business and go for an IPO and so we built the right infrastructure from day one,” he said.

“Going IPO has many advantages for us, such as increased corporate governance and accountability, access to capital, employees long-term incentive, enhanced visibility and brand recognition and ultimately, exit strategy flexibility for some shareholders,” he explained.

“We’ve built four different companies in the fitness sector,” says Alhagbani. “Starting a company from scratch is not an easy process, it’s painful if you want to build it the right way, but we always remain loyal to our family values which represent every company culture we build.

“There are tremendous efforts behind the scenes from the team and the family behind the scenes, driven by our passion and love for fitness which helps us overcome all obstacles and challenges.

“We wanted to play in a different league when we started Armah Sports, time will tell if we manage to pull that off,” he concludes.

Read HCM's previous interview with Fahad Alhagbani hereand see our news feed below.

- News by sector (all)

- All news

- Fitness

- Personal trainer

- Sport

- Spa

- Swimming

- Hospitality

- Entertainment & Gaming

- Commercial Leisure

- Property

- Architecture

- Design

- Tourism

- Travel

- Attractions

- Theme & Water Parks

- Arts & Culture

- Heritage & Museums

- Parks & Countryside

- Sales & Marketing

- Public Sector

- Training

- People

- Executive

- Apprenticeships

- Suppliers