see all jobs

£250m Gym Group floats on London Stock Exchange

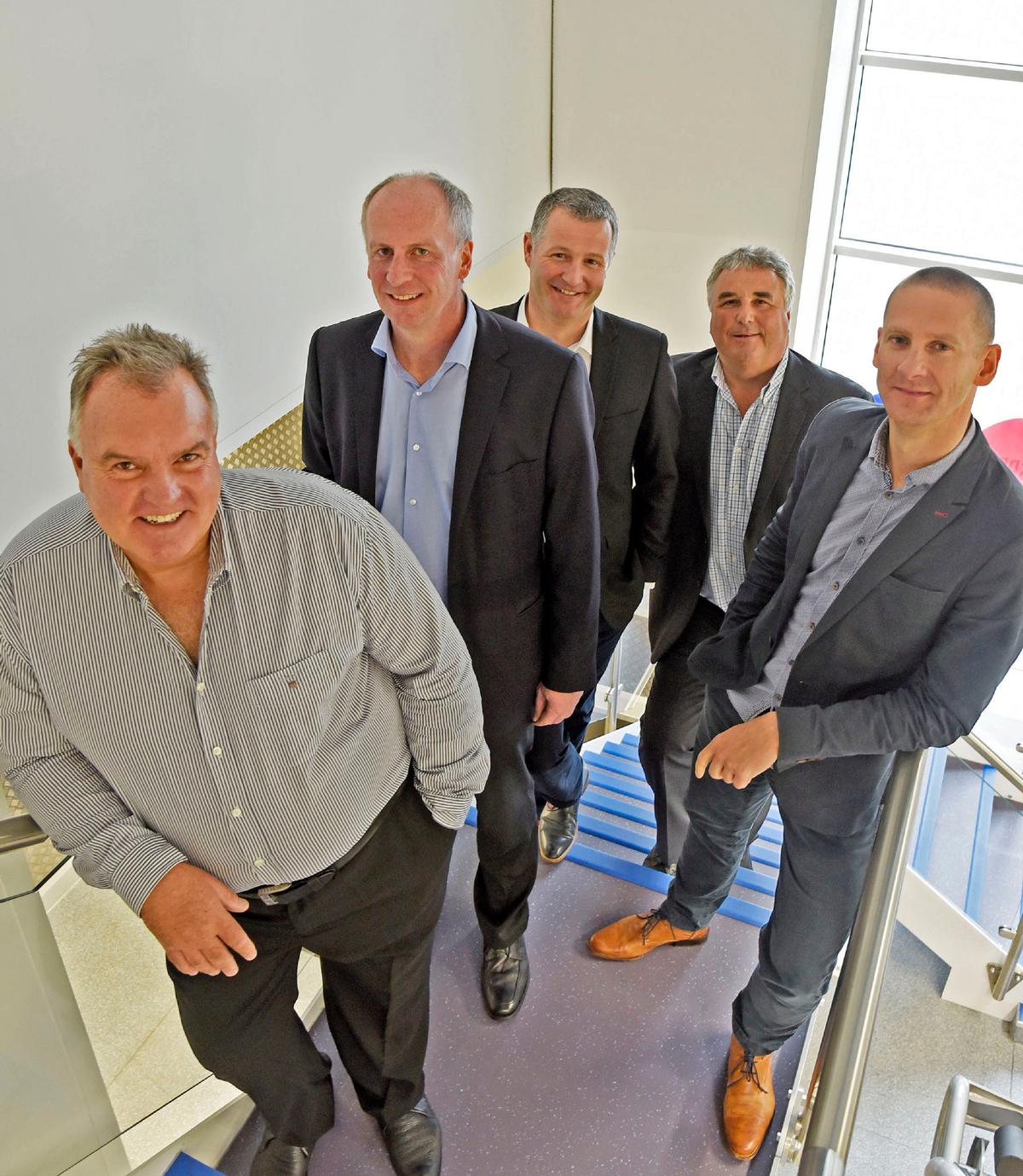

In a historic day for the UK health and fitness industry, The Gym Group has successfully completed

an IPO. CEO John Treharne rang the bell on the London Stock Exchange this morning (9 November) as the shares began trading under the ticker GYM.

The move makes the company the only listed health club operator in the UK and values the business at around £250m, a 17 times multiple on 2014 EBITDA.

Industry analysts have speculated for some time about Treharne’s plans for the rapidly growing company. It had been expected to IPO last month following discussions with investors, but postponed plans when valuations didn’t meet expectations.

However, the talks piqued interest among a number of major investment houses, bringing the company back to the table to negotiate the new deal.

Treharne says there was strong interest from leading Blue Chips and that this resulted in an initial sum of £90m being raised, with the remaining £35m coming in a second tranche, making a total of £125m. This for 64,068,246 shares, valued at 195 pence per share.

The company will receive £89.9m of gross proceeds from the offer to fund future growth.

Although higher amounts were being discussed in late summer, it’s thought the business was hard to value, given the lack of other listed health club operators and that the company scaled back to ensure it had a high quality order book.

In an exclusive interview with Health Club Management, Treharne said: “The calibre of our new shareholders is fantastic, they’re all investors who are in it for the long-term. It shows that health clubs don’t have to be a low level investment.

“Everyone told us our model wouldn’t work – with online joining, 24/7 opening and a low-cost price point – but how wrong they were,” he added.

Treharne said the new deal is a great testament to the team which has built the business, adding that there will be opportunities for them to hold shares in the newly-floated company, predicting it will strengthen the company’s position in attracting talent in an increasingly competitive recruitment market.

He will stay in the business to lead the next stage of growth: “This IPO secures our future,” he said, “We’ll continue to open between 15 and 20 gyms a year, with a focus on quality and quantity. We want to see the business continue to grow sensibly.”

Due to its flexible model, the Company believes there are a significant number of locations in the UK that will support its gyms.

The IPO is expected to raise gross proceeds of £35m for the selling shareholders – managers and directors of the business and backers Phoenix Equity Partners and Bridges Ventures who sold 9,632,213 and 4,767,312 shares apiece at £1.95. Treharne sold 1,700,143 shares.

Phoenix and Bridges will reduce their shareholdings following the float, but will still keep stakes of 28 per cent and 13.9 per cent respectively, with directors and senior managers holding around 6.9 per cent between them.

Penny Hughes CBE has been appointed chair. She is a non-exec of Morrisons, Cable & Wireless and Home Retail Group and also trustee of the British Museum and president of the Advertising Association.

The health and fitness market had a bruising brush with the Stock Market in the 90s, with a number of operators seeking listings and then exiting via the private equity route when things didn’t work out.

But this time Treharne says it’s a different landscape: “Operators opened clubs too quickly during those years,” he says. “That’s why it’s important to grow sensibly now.

“Also, in the 90s, too many operators were fighting over the same group of members, but our low cost model unlocked the market by making it affordable for the masses and creating more demand and opportunity, and this has changed the entire industry.”

Over a third of the Gym Group’s members are first-timers; more than a quarter are shift workers and above 10 per cent choose to work out when other gyms are closed.

“Over time there will be other health and fitness entrants to the Stock Exchange,” said Treharne, “But it’s not straightforward to do what we do – others have tried and failed. It isn’t just a question of converting a gym and dropping the prices, we have a whole model which has been developed to ensure our success.”

Treharne believes budget gyms have democratised fitness in the same way budget airlines have changed the travel business, saying “You have no idea how wealthy the person is sitting next to you on easyJet and the same applies to The Gym – it’s a great leveller and makes fitness affordable and removes barriers.”

The Company’s revenue increased from £22.3 million in 2012 to £45.5 million in 2014 – a compound annual growth rate of 43 per cent.

Group adjusted EBITDA for 2014 was £14.7 million. The Group’s Adjusted EBITDA before pre opening costs for the year ended 31 December 2014 was £16.7m.

The Gym Group has already successfully navigated several rounds of private equity funding to grow from its first gym in Hounslow in 2008 to its current size of 66 gyms and 363,000 members.

More News

- News by sector (all)

- All news

- Fitness

- Personal trainer

- Sport

- Spa

- Swimming

- Hospitality

- Entertainment & Gaming

- Commercial Leisure

- Property

- Architecture

- Design

- Tourism

- Travel

- Attractions

- Theme & Water Parks

- Arts & Culture

- Heritage & Museums

- Parks & Countryside

- Sales & Marketing

- Public Sector

- Training

- People

- Executive

- Apprenticeships

- Suppliers